ASSIGNMENT12

BY

SHADRECK SONES CHITSONGA

SPREADSHEET

This write up is

about the use of the spreadsheet in alleviating some of the tedious

calculations involved in calculating compound interest. There are a number of

ways that compound interest problems can be solved.

Before we do this

let us have a quick review on graphs of exponential functions.

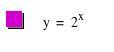

Let us consider

the graph of ![]()

Graph 1

Most of the high

school students are familiar with the graph 1. Using the graphing calculator,

it is easy to read off different values of y and x. Students will need this

kind of skill when we look at compound interest.

What are some of

the methods that we can use to solve compound interest problems. In this write

up we will look at a few of them. But remember our main focus is on the use of

the spreadsheet to solve compound interest problems. The assumption here is

that the students have already been exposed to the other methods of solving

compound interest and that they are familiar with the main concepts on compound

interest.

Let us consider

this question:

John deposits

$500 in a savings account at 5% annual interest. Find the value of his account

after 5 years.

Method 1

Compound interest

can be solved “manually” by calculating the simple interest every year and adding to the

principal. Are there any problems with this method? Look at the example below

and say what you think about this.

Solution

Amount 1st year

$500

Interest 1st year

$500 X .05 = $25

Amount 2nd year

$500 + $25 = $525

Interest 2nd year

$525 X .05 = $26.25

Amount 3rd

year

$525 + $26.25 = $551.25

Interest 3rd year

$551.25 X .05 = $27.5625

Amount 4th

year

$551.25 + $27.5625 = $578.8125

Interest 4th year

$578.8125 X .05= $28.940625

Amount 5th

year

$578.812+$28.940625 = $607.753125

Interest 5th year

$607.753125 X .05 = $30.387656

Amount 6th year

$607.753125 + $30.387656=$638.1407813

Therefore the

amount after 5 years is approximately $638.14.

Now can you

imagine how tedious the calculations would be if we were to calculate the

amount John will have in his account after 40 years.

Ok, may be that is

the time to use the formula for calculating compound interest.

USING FORMULA

![]() Where P is the principal, initial amount, R is the rate in %, t is the time period and

A is the value of the

sum P invested in t years, at the rate of R% per year.

Where P is the principal, initial amount, R is the rate in %, t is the time period and

A is the value of the

sum P invested in t years, at the rate of R% per year.

Now let us apply

the formula to the same problem.

P = 500

R=0.05 , and t =5

A= P(1+R)^t = 500(1+.05)^5= 638.14.

This is

straightforward and very easy to apply. We get the same answer as in the first

method. It seems it is not a problem if we were asked to calculate the amount

John will have in his account after 40 years. In this case it is simply a

question of putting t =

40 in the formula. That should not be very involving.

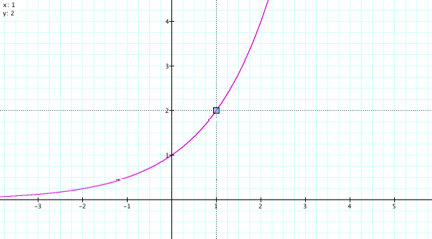

But now what about

if we wanted to know the amount in John’s account every year for the next 40

years. Yes we can use the formula. How many times do you have to apply the

formula to come up with the answer? You may want to try. Of course one can use

the formula and plot a graph by using the formula, just as we did in graph 1.

Graph 2

Using the formula

seems to be ok so far. If we have to plot the graph, then we can read off

different values. But the drawback here is that we can only look at a

particular pair of values at any given time. What about if we wanted to see the

amount in John’s account in years 1-40, all at the same time? We might not be

able to do that using this approach. So what do we do? What about using the

spreadsheet. Look at the example below.

USING THE

SPREADSHEET

So far we have

discussed two methods. The third method involves the use of the spreadsheet.

The table below shows the amount John will have in his account starting from

year 0 to year 40.

TABLE 1

|

Principal |

1+RATE |

YEARS |

AMOUNT |

|

500 |

1.05 |

0 |

500 |

|

500 |

1.05 |

1 |

525 |

|

500 |

1.05 |

2 |

551.25 |

|

500 |

1.05 |

3 |

578.8125 |

|

500 |

1.05 |

4 |

607.753125 |

|

500 |

1.05 |

5 |

638.1407813 |

|

500 |

1.05 |

6 |

670.0478203 |

|

500 |

1.05 |

7 |

703.5502113 |

|

500 |

1.05 |

8 |

738.7277219 |

|

500 |

1.05 |

9 |

775.664108 |

|

500 |

1.05 |

10 |

814.4473134 |

|

500 |

1.05 |

11 |

855.1696791 |

|

500 |

1.05 |

12 |

897.928163 |

|

500 |

1.05 |

13 |

942.8245712 |

|

500 |

1.05 |

14 |

989.9657997 |

|

500 |

1.05 |

15 |

1039.46409 |

|

500 |

1.05 |

16 |

1091.437294 |

|

500 |

1.05 |

17 |

1146.009159 |

|

500 |

1.05 |

18 |

1203.309617 |

|

500 |

1.05 |

19 |

1263.475098 |

|

500 |

1.05 |

20 |

1326.648853 |

|

500 |

1.05 |

21 |

1392.981295 |

|

500 |

1.05 |

22 |

1462.63036 |

|

500 |

1.05 |

23 |

1535.761878 |

|

500 |

1.05 |

24 |

1612.549972 |

|

500 |

1.05 |

25 |

1693.17747 |

|

500 |

1.05 |

26 |

1777.836344 |

|

500 |

1.05 |

27 |

1866.728161 |

|

500 |

1.05 |

28 |

1960.064569 |

|

500 |

1.05 |

29 |

2058.067798 |

|

500 |

1.05 |

30 |

2160.971188 |

|

500 |

1.05 |

31 |

2269.019747 |

|

500 |

1.05 |

32 |

2382.470734 |

|

500 |

1.05 |

33 |

2501.594271 |

|

500 |

1.05 |

34 |

2626.673985 |

|

500 |

1.05 |

35 |

2758.007684 |

|

500 |

1.05 |

36 |

2895.908068 |

|

500 |

1.05 |

37 |

3040.703471 |

|

500 |

1.05 |

38 |

3192.738645 |

|

500 |

1.05 |

39 |

3352.375577 |

|

500 |

1.05 |

40 |

3519.994356 |

|

|

|

|

|

What is the

advantage of using the spreadsheet? May be the question should be what are the

advantages of using the spreadsheet?

1. In the

spreadsheet we simply enter the principal, (1+ rate), years and the formula,

and

we get all the amounts we

need in a fraction of a second.

2. THINK about other advantages.!!!!

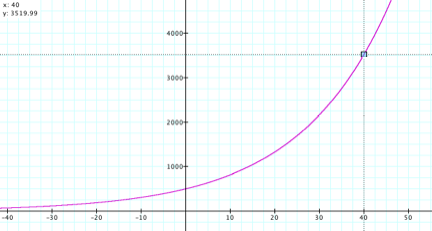

Using the

information from table 1 it is very easy to come up with a curve shown in

figure 2.

This curve shows

that the amount in the account grows exponentially. The formula that is used to

calculate the amount is an exponential function as seen in method 2.

Graph 3

In comparison to

the second method, the spreadsheet has an advantage in that we can see all the

values we need at the same and we can draw the curve easily as shown here. In

method 2, as discussed already we need to read off values from the curve. This

is just one example, there are more other applications of the spreadsheet. You

might want to find out how you can incorporate the use of the spreadsheet in

your lesson

RETURN