Stamps

Over the Years

Assignment

12 Š Diana May

In 2006, the price

of first class stamps rose from $0.37 to $0.39. An increase in stamp

prices rarely surprises people in modern times, but looking back at how the

price of stamps has changed can be quite surprising. We'll look at how

the price of stamps has changed from 1919-2002 and try to develop a model to

predict the price of stamps in the future.

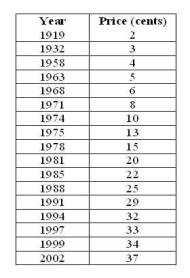

Data

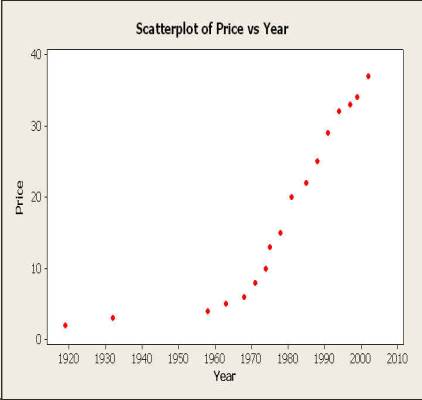

From looking at the

graph, we see that the relationship between the price of stamps and the year is

not quite linear. When we attempt to fit a linear regression line to this

data, we get the following regression analysis:

The regression

equation is

Price = - 914

+ 0.472 Year

S =

6.25393 R-Sq = 75.7% R-Sq(adj) = 74.1%

Analysis of Variance

|

Source |

DF |

SS |

MS |

F |

P |

|

Regression |

1 |

1825.6 |

1825.6 |

46.68 |

0.000 |

|

Residual Error |

15 |

586.7 |

39.1 |

|

|

|

Total |

16 |

2412.2 |

|

|

|

Noticing that this

linear regression equation is not a good fit (R2 = 0.757); we can

attempt to correct for this by transforming the data. Performing a 1/y

transformation on the data, we get the following regression:

The regression

equation is

1/y = 11.2 -

0.00561 Year

S =

0.0355551 R-Sq = 93.2% R-Sq(adj) = 92.7%

Analysis of Variance

|

Source |

DF |

SS |

MS |

F |

P |

|

Regression |

1 |

0.25823 |

0.25823 |

204.27 |

0.000 |

|

Residual Error |

15 |

0.01896 |

0.00126 |

|

|

|

Total |

16 |

0.27720 |

|

|

|

This regression

appears to be a better fit (R2 = 0.932); however, even with this

transformation, we can see from the graph that the relationship is still not

quite linear. It seems that the transformation has distorted parts of the

data that initially appeared to follow a more linear trend. Also, this regression becomes

problematic when attempting to make predictions about future stamp prices, as

weÕll see later.

In

Context

One thing you might

notice is that the trend seems linear up until about 1968 and then the price

increases at higher linear rate. It might be beneficial to consider what

happened with the United States Postal Service around that time. The

Postal Service Act, signed on February 20, 1792 by George Washington, created

the United States Post Office Department as a cabinet department, headed by the

United States Postmaster General. In 1970, the Postal Reorganization Act

abolished the United States Post Office Department and created the United

States Postal Service, a corporation that acted independently of tax dollars

and that had an official monopoly on mail service in the United

States.

Perhaps if we group

prices of stamps into two different categories, based on before or after the

Postal Reorganization Act, we might find more suitable regression lines for the

data.

Conducting a

separate regression on the pre-1972 data set, we obtain the following

regression:

The regression

equation is

Price A = -

134 + 0.0708 Year A

S =

0.537473 R-Sq = 91.3% R-Sq(adj) = 88.4%

Analysis of Variance

|

Source |

DF |

SS |

MS |

F |

P |

|

Regression |

1 |

9.1334 |

9.1334 |

31.62 |

0.011 |

|

Residual Error |

3 |

0.8666 |

0.2889 |

|

|

|

Total |

4 |

10.0000 |

|

|

|

This regression

seems to be a good fit to the smaller data set (pre-1972), with an R2

value of 0.913. The slope of the

regression equation, 0.0708, tells us that each year, the price of the stamp

would be predicted to increase 0.0708 cents. That means that it would take about 14 years for the price

to increase by one cent!

For the post-1972

group, we get the following regression:

The regression

equation is

Price B = -

1858 + 0.947 Year B

S =

1.16083 R-Sq = 98.8% R-Sq(adj) = 98.7%

Analysis of Variance

|

Source |

DF |

SS |

MS |

F |

P |

|

Regression |

1 |

1092.2 |

1092.2 |

810.52 |

0.000 |

|

Residual Error |

10 |

13.5 |

1.3 |

|

|

|

Total |

11 |

1105.7 |

|

|

|

This separate line

does an excellent job fitting the data, with an R2 value of 0.988. Also, the regression equation has a

slope of 0.947, which means that each year, this model predicts the price of a

stamp will increase by 0.947 cents.

LetÕs see how our

different regression equations predict future prices of stamps. The years of interest displayed here

are when one of the regression equations predicts the price of a stamp to be

approximately one dollar (one cents).

|

Year |

Full |

Transformed |

Group A |

Group B |

|

1995 |

27.64 |

124.22 |

7.25 |

31.27 |

|

2067 |

61.62 |

-2.53 |

12.34 |

99.45 |

|

2148 |

99.86 |

-1.18 |

18.08 |

176.16 |

|

3305 |

645.96 |

-0.14 |

99.99 |

1271.84 |

From

our different regression from Groups A and B, we can see that the price of a

stamp would not have reached $1.00 until the year 3305 if the prices had

continued in the same trend before the Postal Service Act, but if they continue

along the same trend as today, the price could reach $1.00 by the year 2067.

In conclusion, when

trying to model data, it is always important to plot the data first to observe

any unusual trends. If any trends

are noticed, further investigation is needed of the context of the problem to

determine if there is an explanation for the trend. Also, when using regression models, always be careful about

extrapolating the equation outside of the scope of the model.

Questions? E-mail me.