Erin Mueller

Excel and APY

Excel can

be used to explore many areas of mathematics including functions and graphs.

Excel is a great tool for exploring annual percentage yields. When money is

deposited into a savings account, this money will accrue interest over time.

This means you will have more money than when you started (assuming you did not

withdraw any) without ever depositing any. The first deposit made into your

account is called the principal amount or the beginning amount. Your interest rate

will vary depending on the length of time the account is open (will depend

entirely upon yourself) and the type of account chosen. Accounts known as

certificates of deposit (CD) will require you to keep your first deposit in the

bank for a certain length of time. You are not allowed to touch this money

while it is in the bank. However, interest rates on these types of accounts

tend to be good and can range from 2% - 6% annual interest rate. Other factors

include how long you tend to keep the account open and how many times per year,

interest is accumulated. It may be yearly, semi-annually, or quarterly,

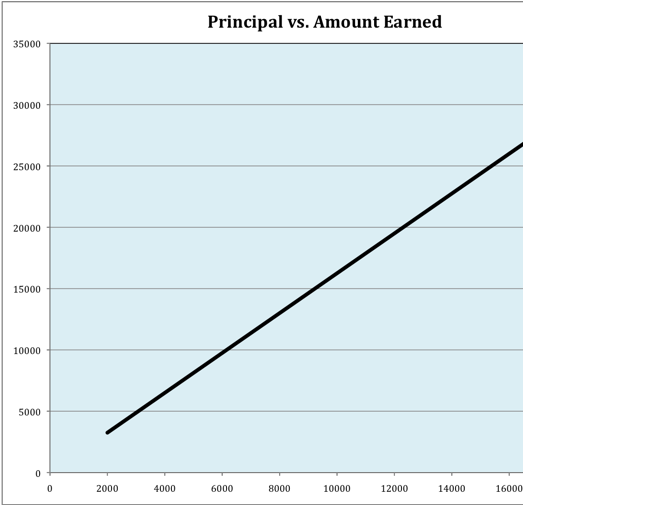

depending on the bank. The Excel chart below shows how much money will be accrued

after 10 years, in which the interest is compounded quarterly (4 time per

year), and the interest rate is 1.99%. The chart shows how much money will be accrued

based on the principal while the length of time, interest rate, and number of

times interested is compounded are kept constant.

|

Principal |

Interest Rate (Annual) |

#Of Times Interest is Compounded

per Year |

# Of Years |

Total Amount in Account After N

Years |

|

|

P |

r |

q |

n |

A |

|

|

2000 |

0.199 |

4 |

10 |

3250.04 |

|

|

2500 |

0.199 |

4 |

10 |

4062.55 |

|

|

3000 |

0.199 |

4 |

10 |

4875.06 |

|

|

3500 |

0.199 |

4 |

10 |

5687.57 |

|

|

4000 |

0.199 |

4 |

10 |

6500.08 |

|

|

4500 |

0.199 |

4 |

10 |

7312.59 |

|

|

5000 |

0.199 |

4 |

10 |

8125.10 |

|

|

5500 |

0.199 |

4 |

10 |

8937.61 |

|

|

6000 |

0.199 |

4 |

10 |

9750.12 |

|

|

6500 |

0.199 |

4 |

10 |

10562.63 |

|

|

7000 |

0.199 |

4 |

10 |

11375.14 |

|

|

7500 |

0.199 |

4 |

10 |

12187.65 |

|

|

8000 |

0.199 |

4 |

10 |

13000.16 |

|

|

8500 |

0.199 |

4 |

10 |

13812.67 |

|

|

9000 |

0.199 |

4 |

10 |

14625.18 |

|

|

9500 |

0.199 |

4 |

10 |

15437.69 |

|

|

10000 |

0.199 |

4 |

10 |

16250.20 |

|

|

10500 |

0.199 |

4 |

10 |

17062.71 |

|

|

11000 |

0.199 |

4 |

10 |

17875.23 |

|

|

11500 |

0.199 |

4 |

10 |

18687.74 |

|

|

12000 |

0.199 |

4 |

10 |

19500.25 |

|

|

12500 |

0.199 |

4 |

10 |

20312.76 |

|

|

13000 |

0.199 |

4 |

10 |

21125.27 |

|

|

13500 |

0.199 |

4 |

10 |

21937.78 |

|

|

14000 |

0.199 |

4 |

10 |

22750.29 |

|

|

14500 |

0.199 |

4 |

10 |

23562.80 |

|

|

15000 |

0.199 |

4 |

10 |

24375.31 |

|

|

15500 |

0.199 |

4 |

10 |

25187.82 |

|

|

16000 |

0.199 |

4 |

10 |

26000.33 |

|

|

16500 |

0.199 |

4 |

10 |

26812.84 |

|

|

17000 |

0.199 |

4 |

10 |

27625.35 |

|

|

17500 |

0.199 |

4 |

10 |

28437.86 |

|

|

18000 |

0.199 |

4 |

10 |

29250.37 |

We can

also see this data in a chart. The Principal amount represents the input

(x-axis) and the output is the Amount Earned (y-axis).

As we can

see, this is a linear function. Note that in this case, the interest rate

remains a steady 1.99%, the number of times compounded in a year remains 4

(quarterly), and the number of years the money is kept in the account remains

10. We can find the regression of our data as well as the r-square value using

Excel. Y=812.51x+2437.5 and r-square

= 1. The r-square value represents the association between x and y. In this

case, the data points accurately portray the linear regression function. Now

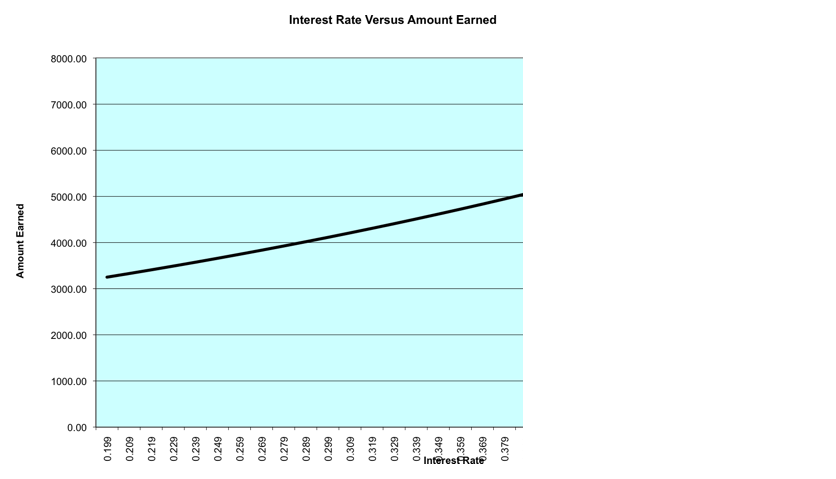

let’s look at what happens when the interest rate is isolated. Below is the

chart of data when the Principal is a constant $2,000, the interest is still

compounded quarterly, and the money is still in the account for 10 years. The

only variable changing is the interest rate.

|

Principal |

Interest

Rate (Annual) |

#

Of Times Interest is Compounded per Year |

#

Of Years |

Total

Amount in Account After N Years |

|

|

P |

r |

q |

n |

A |

|

|

2000 |

0.199 |

4 |

10 |

3250.04 |

|

|

2000 |

0.209 |

4 |

10 |

3328.28 |

|

|

2000 |

0.219 |

4 |

10 |

3408.20 |

|

|

2000 |

0.229 |

4 |

10 |

3489.85 |

|

|

2000 |

0.239 |

4 |

10 |

3573.26 |

|

|

2000 |

0.249 |

4 |

10 |

3658.45 |

|

|

2000 |

0.259 |

4 |

10 |

3745.47 |

|

|

2000 |

0.269 |

4 |

10 |

3834.35 |

|

|

2000 |

0.279 |

4 |

10 |

3925.12 |

|

|

2000 |

0.289 |

4 |

10 |

4017.82 |

|

|

2000 |

0.299 |

4 |

10 |

4112.49 |

|

|

2000 |

0.309 |

4 |

10 |

4209.16 |

|

|

2000 |

0.319 |

4 |

10 |

4307.87 |

|

|

2000 |

0.329 |

4 |

10 |

4408.65 |

|

|

2000 |

0.339 |

4 |

10 |

4511.56 |

|

|

2000 |

0.349 |

4 |

10 |

4616.62 |

|

|

2000 |

0.359 |

4 |

10 |

4723.88 |

|

|

2000 |

0.369 |

4 |

10 |

4833.38 |

|

|

2000 |

0.379 |

4 |

10 |

4945.15 |

|

|

2000 |

0.389 |

4 |

10 |

5059.25 |

|

|

2000 |

0.399 |

4 |

10 |

5175.71 |

|

|

2000 |

0.409 |

4 |

10 |

5294.57 |

|

|

2000 |

0.419 |

4 |

10 |

5415.89 |

|

|

2000 |

0.429 |

4 |

10 |

5539.71 |

|

|

2000 |

0.439 |

4 |

10 |

5666.06 |

|

|

2000 |

0.449 |

4 |

10 |

5795.01 |

|

|

2000 |

0.459 |

4 |

10 |

5926.59 |

|

|

2000 |

0.469 |

4 |

10 |

6060.85 |

|

|

2000 |

0.479 |

4 |

10 |

6197.84 |

|

|

2000 |

0.489 |

4 |

10 |

6337.62 |

|

|

2000 |

0.499 |

4 |

10 |

6480.22 |

|

|

2000 |

0.509 |

4 |

10 |

6625.71 |

|

|

2000 |

0.519 |

4 |

10 |

6774.13 |

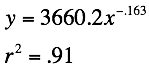

Below is

the graph of the data.

This

function looks exponential. The regression equation and correlation coefficient

for this graph is  .

.

This means

that if we plug a value for the interest rate in for “x”, the out put will be

our amount earned based on a $2,000 principal and ten year, quarterly return.

Next, we

can see what happens when we change the number of times interest is compounded

throughout the year.

|

Principal |

Interest

Rate (Annual) |

#Of

Times Interest is Compounded per Year |

#

Of Years |

Total

Amount in Account After N Years |

|

|

P |

r |

q |

n |

A |

|

|

2000 |

0.199 |

4 |

10 |

3250.04 |

|

|

2000 |

0.199 |

5 |

10 |

2954.80 |

|

|

2000 |

0.199 |

6 |

10 |

2771.62 |

|

|

2000 |

0.199 |

7 |

10 |

2647.11 |

|

|

2000 |

0.199 |

8 |

10 |

2557.05 |

|

|

2000 |

0.199 |

9 |

10 |

2488.92 |

|

|

2000 |

0.199 |

10 |

10 |

2435.60 |

|

|

2000 |

0.199 |

11 |

10 |

2392.74 |

|

|

2000 |

0.199 |

12 |

10 |

2357.54 |

|

|

2000 |

0.199 |

13 |

10 |

2328.13 |

|

|

2000 |

0.199 |

14 |

10 |

2303.18 |

|

|

2000 |

0.199 |

15 |

10 |

2281.75 |

|

|

2000 |

0.199 |

16 |

10 |

2263.14 |

|

|

2000 |

0.199 |

17 |

10 |

2246.84 |

|

|

2000 |

0.199 |

18 |

10 |

2232.44 |

|

|

2000 |

0.199 |

19 |

10 |

2219.63 |

|

|

2000 |

0.199 |

20 |

10 |

2208.15 |

|

|

2000 |

0.199 |

21 |

10 |

2197.81 |

|

|

2000 |

0.199 |

22 |

10 |

2188.45 |

|

|

2000 |

0.199 |

23 |

10 |

2179.94 |

|

|

2000 |

0.199 |

24 |

10 |

2172.16 |

|

|

2000 |

0.199 |

25 |

10 |

2165.03 |

|

|

2000 |

0.199 |

26 |

10 |

2158.46 |

|

|

2000 |

0.199 |

27 |

10 |

2152.39 |

|

|

2000 |

0.199 |

28 |

10 |

2146.78 |

|

|

2000 |

0.199 |

29 |

10 |

2141.56 |

|

|

2000 |

0.199 |

30 |

10 |

2136.70 |

|

|

2000 |

0.199 |

31 |

10 |

2132.16 |

|

|

2000 |

0.199 |

32 |

10 |

2127.91 |

|

|

2000 |

0.199 |

33 |

10 |

2123.93 |

|

|

2000 |

0.199 |

34 |

10 |

2120.19 |

|

|

2000 |

0.199 |

35 |

10 |

2116.67 |

|

|

2000 |

0.199 |

36 |

10 |

2113.35 |

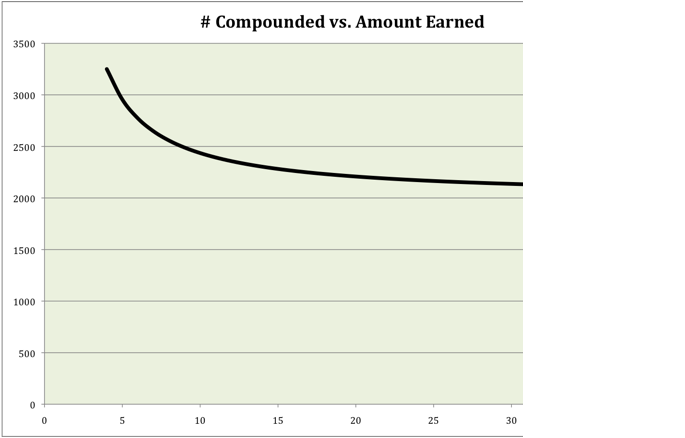

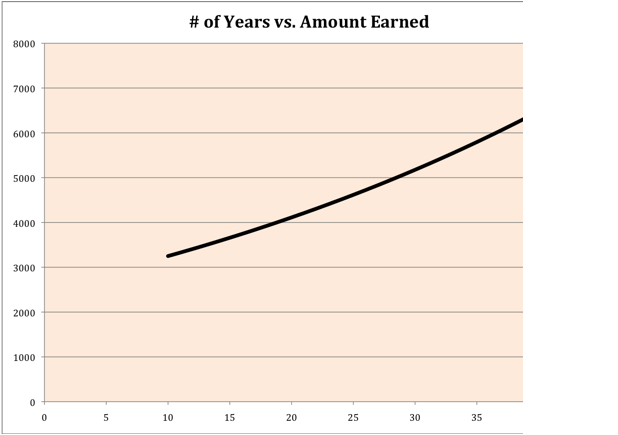

Below

is the graph of the data.

The

regression equation for this function is  . Again, if we plug our compounded value in for “x”, the

output will be the amount earned based on a $2,000 principal, 1.99% interest

rate and a 10 year period.

. Again, if we plug our compounded value in for “x”, the

output will be the amount earned based on a $2,000 principal, 1.99% interest

rate and a 10 year period.

We

can also find a function for the amount of time our money is in the bank. Let’s

look at the chart where the “year” variable changes.

|

Principal |

Interest

Rate (Annual) |

#of

Times Interest is Compounded per Year |

#

of Years |

Total

Amount in Account After N Years |

|

|

P |

r |

q |

n |

A |

|

|

2000 |

0.199 |

4 |

10 |

3250.04 |

|

|

2000 |

0.199 |

4 |

11 |

3328.28 |

|

|

2000 |

0.199 |

4 |

12 |

3408.20 |

|

|

2000 |

0.199 |

4 |

13 |

3489.85 |

|

|

2000 |

0.199 |

4 |

14 |

3573.26 |

|

|

2000 |

0.199 |

4 |

15 |

3658.45 |

|

|

2000 |

0.199 |

4 |

16 |

3745.47 |

|

|

2000 |

0.199 |

4 |

17 |

3834.35 |

|

|

2000 |

0.199 |

4 |

18 |

3925.12 |

|

|

2000 |

0.199 |

4 |

19 |

4017.82 |

|

|

2000 |

0.199 |

4 |

20 |

4112.49 |

|

|

2000 |

0.199 |

4 |

21 |

4209.16 |

|

|

2000 |

0.199 |

4 |

22 |

4307.87 |

|

|

2000 |

0.199 |

4 |

23 |

4408.65 |

|

|

2000 |

0.199 |

4 |

24 |

4511.56 |

|

|

2000 |

0.199 |

4 |

25 |

4616.62 |

|

|

2000 |

0.199 |

4 |

26 |

4723.88 |

|

|

2000 |

0.199 |

4 |

27 |

4833.38 |

|

|

2000 |

0.199 |

4 |

28 |

4945.15 |

|

|

2000 |

0.199 |

4 |

29 |

5059.25 |

|

|

2000 |

0.199 |

4 |

30 |

5175.71 |

|

|

2000 |

0.199 |

4 |

31 |

5294.57 |

|

|

2000 |

0.199 |

4 |

32 |

5415.89 |

|

|

2000 |

0.199 |

4 |

33 |

5539.71 |

|

|

2000 |

0.199 |

4 |

34 |

5666.06 |

|

|

2000 |

0.199 |

4 |

35 |

5795.01 |

|

|

2000 |

0.199 |

4 |

36 |

5926.59 |

|

|

2000 |

0.199 |

4 |

37 |

6060.85 |

|

|

2000 |

0.199 |

4 |

38 |

6197.84 |

|

|

2000 |

0.199 |

4 |

39 |

6337.62 |

|

|

2000 |

0.199 |

4 |

40 |

6480.22 |

|

|

2000 |

0.199 |

4 |

41 |

6625.71 |

|

|

2000 |

0.199 |

4 |

42 |

6774.13 |

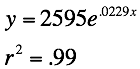

Above,

we can see the effect that “number of years” has on the amount earned. Below is a graph of the data including

the regression equation and correlation coefficient.

Again,

this equation is the natural log function  .

.

From

the above equations for principal, interest, number of times compounded, and

number of years in the account, we can estimate the amount earned based on any

one of these variables.